Investment in anything gives you the best returns. Similarly, now we are going to read about investing knowledge in Finance Career Options in India.

Finance is a thing once you know how to manage will give you everything. Onlinehomeincome is here to help you pick the right finance career options in this industry.

“Knowledge is wealth” wherever, whatever, however you are, your education speaks to others who you are. Having a proper field choice during your graduation will help you to stand routed in your long-term career.

Before discovering a career choice it is important to consider your passion, assess market growth, Industrial future growth, etc. Finance is an essential component of any business and the finance profession is high in-demand jobs.

⇒ Does $10 a day in your bank will make you happy? If so, here is an exciting opportunity for you to start free.

⇒ All you need is a Smartphone with an Internet connection. | Join today!

The best choice you can make is to pursue the finance profession. But before you should try to discover various career options behind choosing it.

There are many career options according to the passion level you can choose to become a financial analyst, Corporate finance officer, and a lot more.

On the whole, As a graduate, it’s important to choose a rewarding career at this point. Scrolling down, this article will guide you through more of a variety of financial career choices and their importance.

You can read more about its academic requirements and career scope etc.

Why is it Important to Take up Financial Career Services?

To become a finance professional, I believe you would know that you have to do an MBA after a bachelor’s degree.

But, few of you would still doubt while pursuing an MBA what specialization to choose?

Here are my few words, everybody knows is the whole world revolves around money. And a career in financial services can put you at the nucleus of money management.

India is one of the fastest-growing countries in the economy around the world. Which contributes a fair amount of share to GDP due to its “financial services”.

According to one of the stats, the financial sector contributes around 6% to employment rise and contributes revenue generation. So, the most flourishing field of choice is choosing an MBA in Finance.

Read More: Best Business Management Courses In India – Top Colleges and Universities

- An MBA in Finance will equip you with a wide knowledge of financial markets, investments, statistics, and corporate finance.

- Along with this knowledge, it also teaches you all facets of managing the business world.

- The specialization will give you a wide insight into how the financial world functions.

- Also, tells you various financial theories that can be applied to solve the various business problems.

Perhaps, you should know how much you can earn if you choose to be in financial services, which in India is Rs. 4,39,856 per annum at an entry level.

These irresistible pay packets offered in some of the finance jobs may be a reason for the high influx of MBA grads choosing the finance stream.

The pay scale that you could have is comparatively less than what professionals in marketing or HR would earn.

What are Some Finance Career Options?

The finance industry offers a wide range of career options to professionals and beginners who possess the right skill sets.

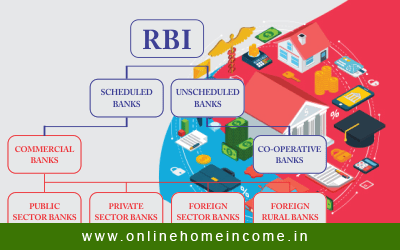

The financial services are multifaceted with various sub-categories like investment banking, asset management firms, hedge funds, etc.

Read more in detail about the available career options as a financial analyst, its career scope, and educational requirements.

1. Financial Analyst

Estimated Vacancies: 1,56,500 nos

Avg. Annual CTC: up to Rs. 3,75,000 INR

The ones who analyze the company’s financial data and utilize the projections to make business decisions are called Financial Analysts.

They possess knowledge in predicting whether to buy or sell a company’s stock based on its overall performance.

More specifically, an analyst must be aware of current developments in the field they are specialized in.

They should excel in preparing financial models to predict the future economic conditions of the company.

Not all financial analysts deal with stock markets or help their employers to make investments.

Perhaps, they also deal with bringing out new marketing techniques at relative cost.

They have the power to determine the keyholes where the strengths and weaknesses lie and make profit, and loss forecasts.

Career Scope

- Financial analysts can find a place to work in any of the local and regional banks. Also, they can work in insurance companies, real estate brokerages, and other data-driven companies.

- Any business that frequently makes critical decisions on spending money is the best place where a financial analyst can work.

Educational Requirement

- To become an analyst one should have a minimum qualification with a major in economics, finance or statistics, mathematics.

- A piece of strong knowledge in statistics, business, administration, and accounting enhances your financial career growth.

You can additionally pursue certification programs like CFA offered by ICFAI. Pursuing a B.com and M.Com, Chartered Accountant, and Company Secretaryship are other ways of becoming an analyst.

2. Corporate Finance

Estimated Vacancies: 1,00,000 nos

Avg. Annual CTC: up to Rs. 33,00,000 INR

If you love playing with numbers, have an interest in maximizing the profit within the minimum budget.

Then choose Corporate Finance Manager as the right finance career option.

As a Chief Finance Officer of a company, your role primarily is to allocate, invest, and save money.

You can be involved in offering guidance and advice on employee enrollment.

Also, you can create a comprehensive plan as to how to strategically reduce the company’s total operational expenses.

At times you can be engaged in maximizing returns and minimizing investments.

Your other roles could be Forecasting profits and losses of the company and negotiating lines of credit.

It also helps in preparing financial statements and getting connected with outside auditors.

Career Scope

- CFO’s generally work under big corporate advisory firms or investment banks. CFO’s also fulfill any finance- and operations-related roles like resource management, people management.

Educational Requirement

- To pursue a career in corporate finance, you have to get a bachelor’s degree in Finance or related fields and get a post-graduate MBA degree in Finance.

3. Commercial Banking Officer

Estimated Vacancies: 1,30,000 nos

Avg. Annual CTC: up to Rs. 33,00,000 INR

Commercial banking primarily involves providing financial services to individuals, small businesses, and large organizations.

In finance career options, working as a commercial banking officer offers exciting opportunities to develop skills by learning about business.

This position also involves interacting with clients and developing business relations. Your role as a commercial bank officer covers a wide range of financial services.

You are the responsible person in the bank for checking and savings accounts to individual retirement accounts and loans.

Career Scope

- One can acquire positions like bank tellers, loan officers, operations, marketing, and branch managers in the commercial banking sector.

- You might also get a chance to work as a Credit Analyst, Loan Officer, Branch Manager, or Mortgage Banker.

- If you develop the right skills and acquire promotion you might work in a sector like International Finance and get to chance to travel abroad.

Educational Requirement

- Mostly, commercial bankers are required to hold at least a bachelor’s degree in business, finance, or business administration. However, other degrees like marketing can also be preferred.

- There are other analyst programs available which might be helpful to avail job in the banking sector. Example: Company like JP Morgan Chase offers two analyst programs that you can avail of.

4. Investment Banking Officer

Estimated Vacancies: 96,000 nos

Avg. Annual CTC: up to Rs. 8,00,000 INR

If you choose to become an Investment banker then that will be one of the most prestigious positions in the whole of financial services.

The typical role of an Investment banker includes new issuance of corporate securities and guiding investors to purchase.

Investment banks also help in trade securities and advise both corporations and individual investors to invest wisely.

You can also work on the financial remodeling of various business operations in an organization.

It is a suitable role for someone who enjoys spotting trends in data and numbers and helps businesses to make calculated decisions.

Career Scope

- In terms of scope, you can find yourself working in the trading desk, trading stocks, bonds, and other securities in the secondary market.

- Or, you could get a chance to become a qualitative research analyst in either stock research, corporate bonds, or other fixed-income securities.

Educational Requirement

- To become an Investment banker, there are no specific qualifications in major required. But you can pick related majors such as finance, economics, business, or accounting.

- Make sure you obtain knowledge in macroeconomics and microeconomics, personal and business finance concepts. Try to learn about business and tax law, international business practice, and strategies that will help get a job.

5. Hedge Fund Manager

Estimated Vacancies: 2,00,000 nos

Avg. Annual CTC: up to Rs. 14,00,000 INR

A hedge fund is a form of investment fund that raises capital from institutional investors and accredited investors.

It then invests it in financial assets in liquid form or publicly traded assets.

If you are extremely passionate about the public markets, creating investment theses, and buying/selling stocks, and bonds then this is the best fit for you.

In Hedge funds, you can be in a position to do wide analysis and generate investment ideas.

Here, you have to perform quants and programming with math/statistics.

In addition to these front-office roles, there are also roles available specifically for trade settlement, compliance, IT, HR, and more.

Career Scope

- At entry level you can join as an investment/research analyst then after the consistent experience, you can get promoted to Portfolio Manager.

- You can also join as Execution Traders, a junior entry-level role, and jump to PM through promotion.

Educational Requirement

- In terms of academics, one must need at least an MBA, or Ph.D. Aditional certification like CFA, CAIA, or CHA always give you a higher chance to get hired.

6. Private Equity and Venture Capital

Estimated Vacancies: 3,50,000 nos

Avg. Annual CTC: up to Rs. 25,00,000 INR

Private equity professionals help small, failed drought businesses to find capital for both their further expansion and current operations.

These firms buy these companies and streamline operations to increase revenues.

Venture capital (VC) professionals invest in startups or small, fast-growth companies. VC firms assess the founders and small-company leaders to determine if the firm will invest.

Sometimes referred to as “vulture capitalists,” VCs are known to deal with the favor of the investor, not the company receiving funding.

As a venture capital analyst, your responsibility will be to network, be aware of the latest industry trends, and meet up with potential target companies.

Career Scope

- After two years as an entry-level analyst, you may get promoted as Senior Associate (two to three years).

- After serving as SA for 2 to 3 yrs you can move to Vice-President/Principal (two to four years), then to Director/Partner and so on.

Educational Requirement

- Candidates should have a bachelor’s degree in any of the majors like finance, accounting, statistics, mathematics, or economics.

- Private equity firms do not usually hire passed out college students. Instead, they prefer the one who has previous significant private equity internships or work experience.

- The private equity firms hire entry-level associates having two years of experience of investment banking analyst.

7. Insurance Advisor

Estimated Vacancies: 3,50,000 nos

Avg. Annual CTC: up to Rs. 5,00,000 INR

A job in the insurance sector could help businesses and individuals anticipate potential risks, to protect themselves from losses.

In common terms, an Insurance advisor is an intermediary person between the company and clients who help in selling life or non-life products.

Career Scope

- In this sector, you could begin working as a sales rep selling insurance policies, as a customer service rep working with existing clients.

- You can work as an actuary computing risk and premium rates according to probabilities based on historical data sets.

Educational Requirement

- The requirement is very not specific to become an eligible Insurance advisor. You have to be more than 18 years of age and 10th pass if you are in rural and in urban you have to pass the 12th exam.

- After fulfilling these criteria, if you want to be a traditional Insurance advisor you have to clear the IRDA exam and join any of the insurance companies and sell its products.

Read More: Top 50 Courses after 12th Standard – Career, Salary, and Job Opportunities.

8. Risk Analyst

Estimated Vacancies: 2,40,000 nos

Avg. Annual CTC: up to Rs. 8,00,000 INR

Just as the name indicates risk analyst plays a vital role in minimizing the company’s risk.

Reducing financial risks by strategically maximizing returns through increased investment.

Risk management professionals are perfectly trained to give consultations based on analyzing the market risk.

And the likelihood of recognizing a bad investment outcome based on the investment.

They further use mathematical reasoning to advise clients to ensure their business model is defined within the company’s mission and vision.

This profession will suit you if you are interested in mathematics and statistics.

Career Scope

- When you gain enough experience you can jump to a senior role and executive roles in the financial sector.

Educational Requirement

- Aspiring risk management professionals have to pursue a bachelor’s degree in Risk Management.

- Students who hold an additional MBA as their master’s degree are widely considered to be recruited.

9. Portfolio Manager

Estimated Vacancies: 4,00,000 nos

Avg. Annual CTC: up to Rs. 18,00,000 INR

If you love commerce and science, a position related to this field best fits you. A portfolio is a frame of the client’s investment status.

Beginning a career as a portfolio manager either for small companies or big companies can be the best finance career option in India.

A career in portfolio management will allow you to make decisions about the investment policies of an organization.

Management of a company’s portfolio is all about discovering its opportunities, strengths, weaknesses, and threats in the domestic and international markets.

Career Scope

- Portfolio Managers can find work at money management firms and hedge funds. They help their clients attain their financial goals without any major risk.

- Its further level position would be president which you could acquire out of enough experience.

Educational Requirement

- You can start this career with a bachelor’s degree in any of finance disciplines such as Economics, Accounting, or Business Administration.

- Education in high-level Mathematics and Statistics are also recommended for this job position.

- A master’s degree in Economics or a post-MBA may also be required in some companies to pursue this job role.

10. Public Accounting

Estimated Vacancies: 4,00,000 nos

Avg. Annual CTC: up to Rs. 10,00,000 INR

Accounting targets a variety of services for businesses as well as private entities.

Similar to a corporate finance career, a public accountant maintains and records the overall money flow for a company.

They also record business transactions, help prepare financial statements, audit financial records, and prepare income tax returns.

The public accounting officer also provides consulting services. He/she is also responsible for suggesting to decrease cost expenditure and boost revenue.

Accountants can also operate as auditors to help companies obtain an overview of their investments. They also help develop financial projections that reflect achieving long-term goals.

Career Scope

- Accountants generally work in partnership companies like Deloitte Touche Tohmatsu, PricewaterhouseCoopers (PwC), Ernst & Young, and KPMG.

- Typically, new hires start as a staff accountant, then they can move further as an audit manager, then tax manager.

Educational Requirement

- A bachelor’s degree in Commerce or Business Administration with a specialization in Accounting is an entry point.

- To become a licensed accountant you can complete a Certified Public Accountant (CPA), which is an internationally recognized one.

- One can also pursue CPA certification along with an MBA in Finance or a master’s degree in Commerce.

How Do I Choose a Career in Finance?

As a student, you have decided to choose a flourishing but challenging career choice in the finance industry. If are you puzzled about what’s next, then this is what you can do.

- You can enroll yourself for graduation in a major generally like Business Administration, Economics, Statistics, Mathematics, etc.

- Then think of pursuing a post-graduate MBA specialization in finance.

- Be aware that there are many colleges in India offering an MBA in Finance.

Specifically, if you’re living in West Bengal, you can choose to study at Techno India University, Kolkata which holds the highest placement record.

Parallelly you can enroll yourself in taking an internship in the particular field that you have chosen.

Because students who have taken internships in their expertise field are given preference by the hiring companies.

You can easily find a job in Investment Banks, Commercial Banks, Money Management Firms, Hedge Funds, and a lot more.

Apart from this, almost every organization has accounts or a finance division where also you can get placed.

While working, you can also concentrate on getting professional licenses like CFA and CFQ. It might help you in getting a promotion to the next level.

Attending training programs related to your career choice polishes your resume and increases your professional knowledge level.

Conclusion

As a student, don’t just get carried away by the outside world’s fancy words and choose random finance as your career option.

When you don’t have enough inner substantial ability or passion towards it, then it could be a pitfall in your life.

The key to an individual’s success is to discover a career with the perfect blend to pursue a career that they are passionate about and one that utilizes their skills.

So, take considerable time to research these various finance career options and discover the best path to take them forward.

Instead, if you think finance service as a career option fits you well then this article will be the best mentor for you.

I am sure it has sailed you through the details of career options that the finance sector has, its importance, and how you can proceed further if you choose to finance.

Lastly, this article would have made you think that there’s no death for finance opportunities, so try to utilize every single opportunity that is around you.