Save some money to secure your future by choosing the best investment options from the following list

When you are reading this article, I am sure that you are now aware of the best investment options in India. The need for investing money from our salary to secure our future is therefore essential for every person.

We all are working for someone or doing some sort of online business or offline business to earn money. But, we never know when we will lose our job or face a loss in our business, but we need financial security.

⇒ Does $10 a day in your bank will make you happy? If so, here is an exciting opportunity for you to start free.

⇒ All you need is a Smartphone with an Internet connection. | Join today!

If you are having a habit of saving money to maintain an emergency fund, then it could be a lifesaver.

But, considering a long-term future, we cannot always work till our 60. A penny saved is a Penny Earned – A great proverb.

Always, earning alone is not enough, but you must be prudent enough how to save money and invest it?

Only by this capability, you can safeguard your hard-earned money. Additionally, you can enjoy the benefits your money gives.

For this, you must have a thorough knowledge of the various types of Investment options. And when you know all the details inside out, you can confidently allocate your money to several types of Investment options.

Additionally, Investments not only keep your money safe but also offer high returns. Hence they become doubly attractive.

Let’s discuss the various investment plans that will give you higher returns to secure your retired life.

1. Types of Investment

Generally speaking, there are various types of investment options that are available in the market.

They can be classified according to purchase power, risks involved, duration of the investment and purpose of investment, etc.

Amongst all of them, the 10 best Investment options discussed below will give you high returns.

The investment options are classified into three categories based on the risk involved in the investment.

They are Low risk, Medium risk, and High-risk Investment Plans.

Risk and return are closely connected

The higher the risk, the more will be your return.

1.1. Low-risk Investment Schemes

These are the best Investment options suitable for those who do not want to take any risk with their money.

For example, senior citizens cannot afford to lose their hard-earned money.

Hence for them, the safety of their Investment gets a higher priority compared to the return.

So they can opt for low-risk Investment options like:

- Bank Fixed Deposits

- Public Provident Fund (PPF)

- Senior Citizens Savings Scheme

In all the above schemes, your money is 100% safe. You can be assured about that and be tension-free.

1.2. Medium Risk Investment Options

Some types of people will be open to taking calculated risks and for such people, medium-risk investments will be ideal.

Such medium-risk options are:

- Mutual funds

- Stock Market Investment

- Equity funds

Usually, the investors involve taking calculated risks by gauging the current market trend and analyzing it.

Depending on the purchasing power, you can take the risk and check your predictions.

1.3. High-risk Investments

There are the best Investment options for people who yearn for more and suitable for those willing to take risks always.

This is very ideal for people such as youngsters and business persons who are willing to do High-risk investments.

This is because youngsters have a high loss of absorption capacity. They can earn their lost money in no time.

And business class people mostly get very good results because of their business acumen and experience in the market.

Such people go for High-risk Investment options like:

- Initial Public Offerings (IPOs)

- Venture Capital

- Real Estate

Now you have got an idea about the various investment methods and now let’s discuss the exact options.

2. Top 10 Best Investment Options

We need money at every stage in our lives and we can earn money by working for a salary and investing.

Now, we will discuss the various investment options suitable for salaried people, and business class people.

The next minutes are going to be a game-changer for people like you who are searching for increasing their wealth.

Carefully choose the various investments and properly execute them to earn decent returns every month.

2.1. Mutual Funds

In today’s world, Mutual Funds have emerged as the most preferred Investment Option because Mutual funds are easy to encash.

Moreover, all the transactions are transparent. Further, there are flexible options to choose from.

In Mutual Funds, your money is invested in stocks, bonds, and liquid funds that are market-linked.

Depending on the performance, you may get high returns on your invested money.

Among Mutual Funds, Equity Funds, Tax Saving Funds, or Equity Linked Saving Schemes (ELSS) belong to the High-risk Investment category.

You get a fixed income when you invest in Income Funds and in case you are planning for retirement corpus, you can go for Pension funds.

In addition to the above, several other Mutual Funds are available.

- Hybrid Funds

- Gift Funds

- Index Funds

Even though Mutual Funds have advantages like tax benefits, it is advisable to follow the given guidelines before investing.

Please assess your needs and goal for your Investment to get a basic idea of your money requirement and its duration.

Then gauge the assets of the scheme you want to buy. Thoroughly check its history and also its current position and stability in the financial market.

After you are satisfied with the credibility, determine your risk level and invest comfortably.

Nowadays, the Systematic Investment Plan (SIP) is very popular. It starts from as low as Rs.500/- per month.

| Description | Particulars |

|---|---|

| Scheme Name | Mutual Funds |

| Risk Involved | Low to Medium |

| Returns | Approx 16% per annum |

| Minimum Invest | Starts from Rs.500 |

| Lock-in Period | Minimum 15Days |

2.2. National Pension Scheme

This is one of the best Investment Options in India and this comes under Low-risk and safe investment options.

This investment scheme is sponsored by the Government along with the pension scheme, which helps the investor to get a pension.

By investing in the National Pension Scheme, you get tax benefits to a great extent.

Under Sections 80CCC and Sections CCD, you will be able to save up to Rs.1.5 lakhs for every financial year.

In NPS, Section 80CCD(1B) allows you to invest an amount of Rs.50,000/- and get tax benefits.

| Description | Particulars |

|---|---|

| Scheme Name | National Pension Scheme |

| Risk Involved | Low |

| Returns | Approx 8% to 16% per annum |

| Minimum Invest | Starts from Rs.1000 |

| Lock-in Period | Minimum of 15 years |

2.3. Invest in Public Provident Fund

This is one of the widely known Best Investment Options, as there are no risks involved; your invested money is safe.

Further, it is very easy and simple to open a PPF account in your nearest Banks and Post Offices.

Almost all salaried employees can opt for Public Provident Fund as their best investment method.

They can contribute a monthly amount from their salary to this PPF account. An interesting aspect is the PPF interest is non-taxable.

Also, there are loan and early withdrawal options which are highly helpful for the investors.

| Description | Particulars |

|---|---|

| Scheme Name | Public Provident Funds |

| Risk Involved | Low |

| Returns | Approx 9% per annum |

| Minimum Invest | Starts from Rs.1000 |

| Lock-in Period | Minimum 15 Years |

2.4. Invest Money in Real Estate Properties

This has been an Investment Option since the very early days and is considered the long-term Investment Option.

The RERA (Real Estate Regulation and Development Act) has considerably given an impetus to the Real Estate Market.

So now both buyers and sellers are safe with their money. As we all know, Land is a limited resource and the development of cities is rapid.

Hence there is always a demand for lands and houses as well.

Further, if you have enough cash and are willing to wait, this Real estate Investment is the best option.

Assuredly, you will get excellent returns on your property. These days, even rental rates are hiked by 10% every year in metropolitan cities.

This ensures that even inflation costs are handled in this kind of Investment. So this qualifies as the top Investment Option.

Also by availing of home loans, you get considerable tax savings. By paying Equated Monthly Instalments (EMIs) instead of rent, you get a home and also avoid tax.

Thus it is a two-way advantage.

| Description | Particulars |

|---|---|

| Scheme Name | Real Estate Property |

| Risk Involved | Medium |

| Returns | Approx 11% per annum |

| Minimum Invest | Based on your ability |

| Lock-in Period | Not Applicable |

2.5. Stock Market Investment Options

This is one of the most popular investment options with little risk and brings your high returns over some time.

Though it is not completely risk-free like Public Provident Fund (PPF) or National Pension Scheme (NPS), it still attracts huge Investments.

This is because of the high returns people get by investing in stock markets.

Hence Business persons and those willing to take moderate risks find this a suitable and best investment option.

There are different types to invest in – small, midcap, and large-cap stocks.

By assessing the risk factors and after getting proper expert guidance, you can invest in Stock Markets.

Generally, it is preferable to invest in different stocks with a balanced portfolio to avoid heavy losses.

The fluctuations in the Stock Market are extremely high and hence it is advisable not to have it as your sole option.

Observe the market trends, learn all the nitty-gritty of the business and then plan the Investment carefully.

| Description | Particulars |

|---|---|

| Scheme Name | Stock Market |

| Risk Involved | Medium to High |

| Returns | Approx 15% to 18% per annum |

| Minimum Invest | Starts from Rs.500 |

| Lock-in Period | Not Applicable |

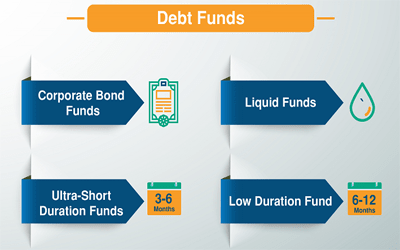

2.6. Invest in Debt Funds

Investing in debt funds is considered a low-risk investment and is considered pretty safe for the common people.

Debt funds are a type of Mutual Fund and in this, the money is invested in Bonds, Debentures, and Fixed Income Assets.

The accruing interest is used to return the money to the investors.

Although the returns are not quite high, some prefer Debt Funds as they give more interest than Bank Fixed Deposits(FD).

Also, they have flexible options when compared with Fixed Deposits.

That is Debt Funds can be easily transferred to equity schemes or any other choice as per the investor’s wish.

This is an added advantage as the terms for Fixed Deposits are very rigid and give high liquidity and offer tax benefits also.

| Description | Particulars |

|---|---|

| Scheme Name | Debt Funds |

| Risk Involved | Medium |

| Returns | Approx 8% to 10% per annum |

| Minimum Invest | Starts from Rs.1000 |

| Lock-in Period | Minimum 3 Years |

2.7. Invest Your Money in E-Gold

Since the early days, Gold is considered a secured investment by most of the common people in India.

This is because it is closely associated with our culture and beliefs. But it is also difficult to safeguard Gold.

It involves paying huge locker rents, taking jewelry and Gold safely to Banks, and such.

E-Gold is the answer to all the above problems. Gold bought in electronic form is called E-Gold.

It is sold by National Spot Exchange Limited(NSEL). You can buy gold in any denominations you like to say, starting from 1 gm, 2 gm, etc.

For this, first, you must have a Demat account with Depository Participant(DP) of National Spot Exchange Limited.

You can buy it as per your requirement and it will be kept in the DP on your behalf. You can surrender the units and take your gold back if needed.

Mumbai, Delhi, and Ahmedabad have these Gold delivery centers. Roughly, it takes T+2 days for settlement.

Investing in E-Gold has many benefits as follows:

- Wide range of Investment Options

- High Liquidity (starts from 1gm)

- Transparent and easy transactions

- High Returns

- No fear to safeguard the Gold

- No Bank Locker rentals

Hence E-Gold as an Investment Option is highly popular nowadays.

| Description | Particulars |

|---|---|

| Scheme Name | E-Gold Bonds |

| Risk Involved | Low to Medium |

| Returns | Approx 10% per annum |

| Minimum Invest | 1gm gold rate |

| Lock-in Period | Minimum 8 Years |

2.8. Invest Your Funds in RBI Taxable Bonds

RBI Taxable bonds are also known as RBI Savings Bonds which is another good choice of investment with high returns.

Because they offer a 7.75% interest per annum whereas Government Banks give only up to 6.75%.

If you have surplus money and do not have any immediate financial need, you can safely choose this option.

The term period is 5 years and this investment scheme will earn a cumulative option that gives a 7.6% interest.

If you want periodic income, you can opt for a non-cumulative option that comes with an attractive income rate and gives half-yearly payments.

You can buy these Bonds from Nationalised banks or Stock Holding Corporation of India and are issued in Demat form.

The lock-in period is less for senior citizens and varies according to their age.

They are a good option considering the reducing interest rates offered on bank deposits and easy maintenance.

| Description | Particulars |

|---|---|

| Scheme Name | RBI Taxable Bonds |

| Risk Involved | Low |

| Returns | Approx 7.6% per annum |

| Minimum Invest | Starts from Rs.1000 |

| Lock-in Period | Minimum 5Years |

2.9. Bank Fixed Deposit Investment Schemes

These have been one of the well-known best and safe investment options. Here people invest their money for a fixed period.

They are also called Term Deposits. This investment will pay you interest monthly, quarterly, half-yearly, or annually.

Sometimes, you can re-invest your monthly interest until the maturity of your investment period. After the period, you get it returned with the interest.

Although it is safe, nowadays Banks are reducing the interest rates on Deposits. So it is difficult to handle the increasing inflation costs.

Also, some banks have preclosure penalties and conditions.

While Private Banks offer high-interest rates, the money invested in such Banks is not as safe and assured as with Government Banks.

Hence people prefer Government Banks for Fixed Deposit Investments. Senior Citizens have an extra advantage in Fixed Deposit Investments.

Their Deposits earn higher interests and hence give them good returns.

| Description | Particulars |

|---|---|

| Scheme Name | Fixed Deposit |

| Risk Involved | Low |

| Returns | Approx 7% per annum |

| Minimum Invest | Starts from Rs.1000 |

| Lock-in Period | Minimum 7Days |

2.10. Senior Citizens Saving Scheme

This is a very good investment option for Senior Citizens above 60 years. The Indian Government offers this service only to Indian Nationals.

The maturity period is 5 years and can be extended up to a further 3 years. This offers an excellent interest rate of 8.6%.

Hence this senior citizen saving scheme gives the highest interest rate among all such savings schemes.

Almost all leading banks and post offices have the facility to open and maintain SCSS accounts.

You can open an SCSS account in a Bank or nearby Post Office.

As it is a Government scheme, wherever you open the account, all the terms and conditions will be the same.

You can create a standing instruction to get an interest in your savings accounts in the bank or Post Office.

Furthermore, you can start this scheme with a minimum deposit of Rs.1000 also.

Individuals 55 years of age and who have got VRS or Superannuation are also eligible to join this scheme.

| Description | Particulars |

|---|---|

| Scheme Name | Senior Citizens Saving Scheme |

| Risk Involved | Low |

| Returns | Approx 8.6% per annum |

| Minimum Invest | Starts from Rs.1000 |

| Lock-in Period | Minimum 5 Years |

Conclusion

Properly investing money and getting high returns is extremely crucial. This becomes more relevant with the rising inflation costs of urban living.

As the Joint family system is slowly disintegrating everyone is compelled to be financially independent.

Hence both working professionals and senior citizens must be aware of good Investments.

Because a lack of such knowledge leads people to invest in fraudulent chit companies and bogus schemes.

As a result, they lose their hard-earned money and end up visiting consumer courts. So awareness is highly important.

Hence learn properly about the Best Investments to save your money. Put your money in safe hands and see them growing!

Some of the investments give you a fixed income and some are market-linked with medium to high risks.

Anyhow, all the investments are made to increase your wealth while you are earning by working or doing business.

This article helps you to plan for the best investment to secure your future.