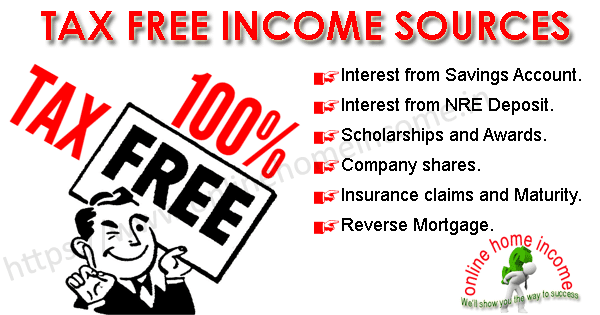

This Article Educates you to Save Money through various Tax-Free Income Sources.

It’s time to pay taxes. Right, Yes, we live in India and as per the constitutional law, we are liable to pay tax on our Income. I thought to write this small list of the tax free income source in India to help minimize your tax burden.

March month is always a special month of the year because all the companies and individuals who fall under tax slabs should have to file taxes based on their income?

⇒ Does $10 a day in your bank will make you happy? If so, here is an exciting opportunity for you to start free.

⇒ All you need is a Smartphone with an Internet connection. | Join today!

Everyone has to pay income tax, even though most people do not like to pay taxes. They find some other possible ways to hide their income to minimize their tax.

People need money for their living and to earn money, people should go to work (or) do any online jobs from the comfort of their home. And once the income crosses the tax limit, you have no choice unless pay tax.

The government collects tax from every individual based on their earnings because tax helps to build the nation.

On the other hand, some people hesitate to pay Income tax on their hard-earned money. This created a curiosity in me to write this article to share some of the tax free income sources to save money.

If you earn money from these sources, then you are not liable to pay taxes to the government. This article is for informational purposes only and you should know the income tax rules clearly.

Pay tax to contribute your growth to our country.

What is Tax?

It is a kind of a compulsory contribution to the (central or state) government by the citizen, levied by the government on the income from the salary (or) a business profit (or) a commission on a sale (or) from the lotteries, games, etc.

There is a law to regulate the collection of taxes under the various schemes and are controlled and monitored by a board called as Income Tax Department of India.

Who is Liable to File Income Tax?

For all Indian Citizens whose age is below 60 and their individual income crosses Rs. 2.50 lakhs.

If your age is between 60 to 80, then the limit is Rs. 3lakhs, whereas, if you already crossed 80 years, it is Rs. 5.00 lakhs per year.

Why Are Taxes Collected?

Every individual is working to earn money and similarly, governing bodies need finances to run the government.

The sole purpose of the tax is to fund all the government expenditures and to provide various public services such as transportation, basic amenities including roads, street lights, street cleaning, etc.

The funds collected from the tax will also be used to increase arms and develop defense security of the country and other welfare work.

When to Pay Taxes?

One financial year is accounted for from 1st April of the previous year to the 31st March of the concurrent year.

A salaried person should pay his/her tax before June of the previous year and the companies should pay every month because after the implementation of GST.

We are not going deeper as our main focus on this article was to discuss various free non-taxable free income sources.

Different Tax Free Income Sources

Although tax payment is good for the development of a country but as an individual when it comes to paying tax we usually hesitate. But there are some ways to increase your income that are non-taxable.

Thinking… Yes, that is true! The Government of India has declared tax exemption to a certain class of income and we are further going to read these sources in this article.

1. Income from Savings Account

Under Income Tax Act 80TTA, an individual can claim a tax benefit up to Rs. 10,000 in the financial year for the savings account interest. Let’s say you earned a saving bank interest of Rs. 14,000 in a fiscal year.

When accounting for this income, it is enough to pay tax only for Rs. 4,000 from which Rs. 10,000 is exempted for all age groups of people. This is a great saving and a source of tax free income for all taxpayers.

Most people usually have more than one savings in a different branch of the same bank (or) entirely different bank, and you can sum up all interest together before assessing for the tax liability.

2. Interest from NRE Account

Like bank savings account in India, the interest from NRE deposits is also not liable to tax and you can claim 100% of the interest.

Both fixed deposit and savings bank interest are eligible to claim no-tax on every fiscal year. Many NRI’s were taking the loan from the country where they are working and investing the money in NRE deposits.

This is a common practice because the interests of foreign banks are 2 – 3% whereas, in India, it is 7 – 8%. As an NRI, you enjoy huge tax savings using this idea.

3. Scholarships and Awards

Any scholarships, awards are exempted from tax as long as the institution where you receive such compliments is legally registered and a recognized body.

Educational scholarships, fellowship awards, and grants are also treated as tax free income sources.

This criterion applies to the awards and rewards offered by the government (or) any other body approved by central or state government.

4. Shares of Company Profits

When A and B are joined together and running a business firm and if the company earns a pure profit in a fiscal year, instead of retaining it, if it is paid to both the partners as the share of profits, then it is considered as a free taxable income.

Because the company had paid the necessary taxes already to the government and hence it is not necessary again to pay one more time.

5. Maturity (or) Claim from Insurance

The money you receive from the life insurance companies on maturity, claims are considered as 100% free non-taxable income sources.

6. Reverse Mortgage

This is eligible for the senior citizens over 60years of age, who suffer from monthly cash flow requirements.

They can opt for the reverse mortgage of their residing home for a handsome payment.

The money they receive from mortgaging will be treated as tax-free and only residential properties can be reverse mortgaged.

7. Agricultural Income

Under no circumstances, all the income that is earned from agricultural land in India is completely exempted from tax.

Either they earned by crop cultivation (or) in the form of rent (or) in the form of a lease (or) any revenue gained by selling their agricultural land are all non-taxable.

Even if you generate income through a small farmhouse like maintaining a nursery (selling seeds and saplings) are also considered as agricultural income and exempted from tax.

8. Travel Allowance in your Salary

The gross salary of every employer consists of various components where they can use to claim tax exemption. In them, the LTA allowance was the one that is not liable to tax every fiscal year.

This allowance is provided by the employer to the employee every year and while accounting for tax, if you provide proof of travel, you can save up to Rs. 20,000 in a year.

So every time, when you sign your salary slip, take a look at the LTA component of your slip else to ask your employer to restructure your salary.

If your yearly take-home salary is Rs. 5,00,000 per year and your LTA was Rs. 20,000 assigned by your employer, then you need to pay income tax only for the remaining Rs. 4,80,000.

Travel allowance is a source of tax free income for every employer and the maximum limit in a fiscal year is Rs. 20,000.

9. VRS Surrender

If an employee voluntarily retires from his/her service, and the settlement after his/her VRS was considered as tax free up to the limit of Rs. 5 Lacs.

The employees who work for a public sector company (or) an authorized established under the control of central or state government is eligible for this income.

10. Income from Provident Funds

Provident funds are compulsory for every employee working for a company. It is an indirect saving for them while working.

As your age grows, your savings will also grow proportionately with time. After your retirement, you can earn this PF money as one single big settlement that is exempted from tax.

Else if you changing your company after a period of 5Yrs, and you want to close your PF, then the money provided is tax-free (only after the 5Yrs lock-in period).

All the income from the government-authorized provident funds, recognized fund departments are considered as free tax income.

But do not withdraw before 5Yrs as it becomes ineligible to claim no-tax on this income.

11. Income from Mutual Funds (LTCG)

A mutual fund is a kind of investment scheme, usually run by some asset management company where a group of people invested their money in stocks, bonds, and other securities.

The investment is for a fixed period of time starting from one month to many years. There are two types of income you can generate from mutual funds: One long-term capital gain (LTCG) and the other one was generating dividend income among shareholders.

It works very simply, you have to find SEBI registered traders in your locality and invest some capital with them.

They, in turn, use your investment to invest in various sources and bring you back the returns. Many people often don’t know that returns from mutual investments are tax free income.

Both the income (long-term capital gain) and the dividend shares are also free from tax.

Caution: The provision is exempted to only SEBI registered affiliates and some financial institutions set by public (or) private sector banks authorized by RBI.

12. Income from Gifts

Any money you get as a gift on your marriage (or) any other occasion from your friends, relatives, or any third person will be treated as a non-taxable income source for you.

Even expensive gifts such as Gold are also considered non-taxable assets. You should provide proof for the asset if received on the date of your marriage.

Gifts you received from your friends (or) distant relatives have a monetary value of Rs. 50,000 exceeding the value is taxable. But there is no limit to gifts from close relatives.

Close relatives are your father, mother, own sister, own brother, spouse, any lineal ascendant (or) descendant, etc.

Think of your father who wants to buy you a brand new car, ask him to hold for a while and gift it to you on your marriage occasion will save you a lot of taxes.

The money spends to purchase the car, (say Rs. 10 lacs) is completely tax free income for you.

13. Money from WILL (or) Inheritance

If your ancestors have written a WILL putting your name as their nominee after their life, then the property (or) asset will be yours and completely non-taxable.

Now, when you invest that money (or) use the property to generate, only the interest part will be taxed.

14. Income from Government Securities

Any income earned as an interest received from securities, bonds, annuity certificates, savings certificates are also treated as tax free income.

Under Section 10 (15) (iv) (h), such income is fully exempted from the Income Tax.

If you own a bond (or) exchange-traded fund, you will need to calculate the amount of income earned from such instruments.

You need to report this income when filing your taxes, but it will not be accounted for by paying the taxes.

15. Dividend Income

Any dividend income you receive on your stocks is tax-free in your hands. There is a limit on the net value of dividends in a financial year not exceeding Rs. 10 lakh in a year.

The dividend that you receive should be from a registered Indian Company. However, the company pays the dividend distribution tax to the government before giving it to its shareholders.

16. Relief Funds

Any amount received from the government by an individual as a relief fund (or) student’s fund (or) from the foundation is considered as not liable to tax.

Under Section 80G of the Income Tax Act, all such donations made (or) received are 100% not liable for the tax.

17. Retrenchment

The money received as compensation to the employee in case of company closure is considered tax-free.

Retrenchment means the termination of the service, by the employer. If the employee is suspected on the grounds of any misconduct or for any other disciplinary action or company closure.

Termination on such reasons under financial compensation by the employer is called Retrenchment Compensation.

Under Section 10(10B) of the Income Tax Act, such compensation is exempted from tax audit and considered as tax free income.

18. Income from HUF

If you are a member of HUF and assuming you receive any sum of income, such amount will not liable to tax in your hands. You will get a 100% tax exemption on the amount you gain as HUF income.

Conclusion

It’s the dream of every people to live a debt-free life. To achieve this dream, they go for a job (or) do some kind of business to earn money.

In India, all component of income is taxable and as a good citizen, you should do your duty to the country by paying tax on your income.

As the monthly wages are not enough to manage expenses, the income tax eats a considerable portion of your income which many people hesitate to pay.

This article was written to create a small awareness to the people who don’t know these kinds of income opportunities that are tax-free.

I have covered a few portions of tax free income sources researched based on my knowledge to enhance our community growth.

Pay Tax and Save Tax, Support India.

Thanks for sharing the informative article, I really like this post.

THIS ARTICLE IS VERY INFORMATIVE AND HELPFUL BUT CAN YOU LIST DOWN MORE WAYS TO SAVE TAX IF THERE ARE ANY OTHER WAYS THAN THESE?

We will update every article frequently. Keep watching this space for more updates.