Next time, when you use your credit cards, plan how to spend to save money?

In the olden days, people used metal coins and currency notes for financial transactions and with the introduction of banks as a medium instructor for financial transactions, cheque transactions became popular.

Later, they introduced Debit Cards and Credit Cards for financial transactions where you can purchase anything (or) pay for a service without carrying cash in your hands.

You may see many people using a word called Credit Card often, which is used to pay bills, pay for services, etc.

There is a small difference between a debit card and a credit card which we will discuss later.

The main context of this article is to reveal the rarely used option of credit card and that is we can save money.

Is it shocking!

⇒ Does $10 a day in your bank will make you happy? If so, here is an exciting opportunity for you to start free.

⇒ All you need is a Smartphone with an Internet connection. | Join today!

But most people don’t know about this wonderful option and instead mostly use it just like they are using debit cards.

If you learn how to use your credit card smartly, you may come up with saving money while you spend money on your card.

It’s a fact, some experts were using their credit cards smartly and takes advantage of saving money.

We will discuss this in this article and it will help you if you are a credit card user (or) going to apply for a new card.

1. What are Credit Cards?

It is a small plastic made card issued by a bank to their account holders, which can be used for purchases (or) pay for services etc.

There is no need to have a balance in your savings account (or) current account, instead, a bank will pay for the POS and give you grace time to repay the money you spent.

It’s like borrowing some money from your friend and then giving it back after some time. Normally, all credit cards have a preset period of 45Days to settle back the money you spent.

If you don’t pay it back on time, then you will have to pay interest and penalty charges for the money you owe to the bank.

2. Different between a Credit Card and Debit Card

Both the card works similar but when you spend money at any POS using your debit cards, the money will be directly drawn from your saving accounts (or) current account.

Whereas in credit cards, it works slightly differently, that is the bank will pay the money to the merchant instead of drawing from your account and give you a grace period to settle back.

Normally it will be 45days from the date of POS.

If you don’t have a balance in your bank account, then you cannot use your debit card but here, you will have some credit limit where you can spend up to the threshold.

3. How do Credit Cards Save Money?

Normally you use the credit card on most purchases directly at POS (or) online payment gateway. But, this time you after reading this article just make some changes in the way you use the card.

Surprisingly you may save almost 30% of your monthly expenses that were spent for paying bills, dues, settlements, etc.

Already I wrote an article on Money-saving tips, where I explained one important point, do spend your money smartly and make a plan before each spends.

Same here too, instead of using your credit card just like your debit card, make some small changes in the way of using get you more savings.

Let me explain to you how credit cards save you money?

3.1. Cash Back

This is one of the best ways to save some money. Most credit cards offer cashback on specific purchases and at some point of sale with certain merchants.

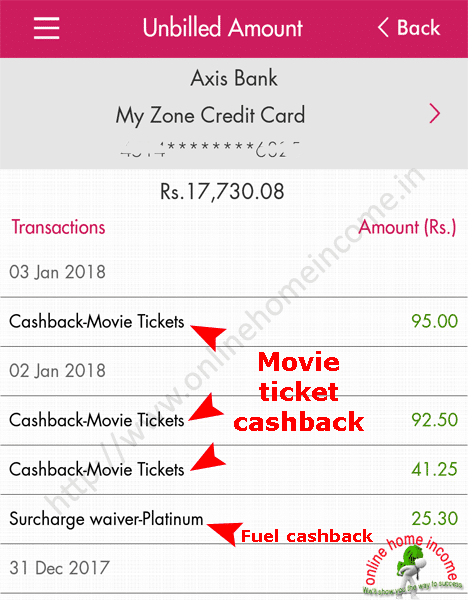

I am using Axis’ Bank’s credit card for paying monthly bills and dues. There are many varieties of cards available to choose from. So read their documentation before applying for a new credit card.

Axis bank’s credit cards do have many variants and in specific, if you choose My zone Visa card you will get the following benefits:

- 20% Cashback on Movie tickets

- Reward points on spending at the restaurant

- 10x reward points on weekends.

Most people will go to a movie at least once a month. So next time when you book a movie ticket, pay the charges through your credit card instead of using Net Banking (or) Debit Card.

Save 20% of your money. If you are about to book a movie ticket for a family of 4, and the one ticket cost is Rs. 250. So the total cost is Rs.1000/-.

You need to pay 1000 Rs if you pay with a debit card (or) net banking, but I will use my credit card for this transaction because I can get a 20% cashback from Rs.1000 [Rs. 200 Pure savings]

I am using my credit card every time when I book movie tickets where I get 20% Cashback every time.

Total Saving is Rs.200 x 12 months = Rs. 2400/- is worth.

3.2. Use Reward Points

Cashback is not the only option for saving money, you can use another option called reward points.

Pay your next bills with a credit card wherever possible because you can earn reward points on every purchase which you can redeem later.

I am using my credit card to pay my electricity bill, internet bill through PayTM, Freecharge which is saving me 5% of my money as cashback.

When I go out for weekend dines, I use to pay restaurant bills with my credit card because I can earn 10X times reward points.

During weekdays you get a 1Reward point per Rs. 100 spent, but at the weekend it’s 10 times larger.

Accumulate your reward points and purchase anything from their own store [Card issuer]. I use to buy products from Axis Store.

I recently bought an 8GB Sandisk Pen drive using my credit card reward points and I saved money worth Rs. 450 INR.

There are different types of credit cards issued by different banks, so compare credit cards and choose the one that best suits your lifestyle.

I use it mostly for Weekend Dine, Movies, Car Fuel, Internet, and Telephone Bills, EB Bills, etc. You cannot make the most of one card, it’s better to have two (or) three cards in my opinion.

3.3. Raise Credit Score and Save on Loans

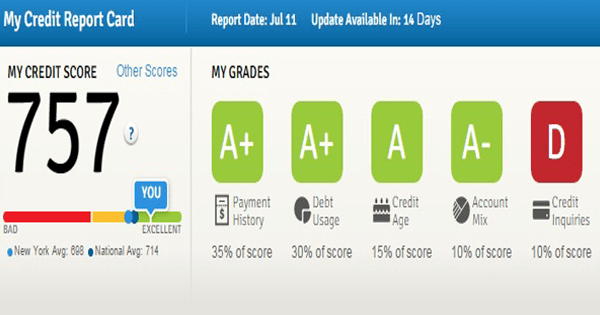

You know well about credit score as it is calculated whenever you apply for a vehicle loan, personal loan, mortgage loan, etc.

The more credit score you have the lesser the interest on your loans. The better the credit score, the better your credit value for bankers.

For example, when you apply for a mortgage loan of 20years for the sum of Rs. 30,00,000, the interest rates on an excellent credit score (over 800) will be lesser than a fair credit score (less than 650).

You may ask how this can be possible. I will tell you.

There are nearly 100’s of banks and private financial bodies in India to offer various loans. Take the same example above, you want to apply for a mortgage loan of Rs. 30,00,000 and your credit score is 735.

If you apply for a mortgage loan with SBI their interest rates were 8.67% [But usually they approve loans for the individuals with a credit score over 700 and the rest application will be rejected].

If your credit score is less than 650, your only option is private financial bodies whose interest rates are more than 12%.

That’s why I can strongly say you can save money on your credit cards on loans.

If you are a credit card user, maintain a no-default history in your payments and pay all your bills, dues and settlements on time.

Maintaining a proper transaction in credit cards will help increase your credit score too.

3.4. Costs of Cash

Carrying a credit card is more convenient than carrying cash and it helps you save money.

If you want to withdraw cash from ATM with your debit card, you need to pay Rs. 20 per transaction after the first free 3 transactions.

Most merchants in India have POS machines to collect payments from their customers, so from next time pay your bills through cards and stop paying in cash.

While traveling somewhere, if you lose your wallet, your cash is also gone. But with credit cards, no such things will happen to your money.

Many credit cards come with zero liability coverage for false and unauthorized spending. So you are pretty safe with your money.

Do not keep your pin with your credit card unless it merely likes losing your wallet full of money.

3.5. Credit Card at Groceries and Petrol Pump Stations

I always use a credit card for my monthly grocery purchases because I can use the cashback offer (or) reward points.

I use to make my monthly purchases from supermarkets and departmental stores where I use PayTM to pay the bills.

Sometimes, I use to purchase on Saturdays and Sundays to get more reward points.

I love driving cars especially my White Beast Mahindra Scorpio S10, which I purchased with my earnings from Online Business.

We need to fuel our vehicle whenever it runs out, of course, the cost of 1litre diesel is Rs.62 and 1 Litre petrol is Rs. 75.

Already Central Government of India announced a 0.75% discount on fuel purchase using a debit card (or) credit card. [Premium cards only eligible for this]

Additionally, my credit card itself has a 1% cashback on fuel expenses. When I travel, I use my card for paying for fuels both for my car and my bike.

So the total saving is 1.75% every time when I refill fuel for my vehicles. In this way, I can save an average of Rs. 17.50 per Rs. 1000 spent.

It’s better huh! Will you follow my idea next time?

3.6. Car rental Insurance

This is an amazing use of every credit cardholder. Yes, that is insurance protection for any damage (or) theft of your rented car.

When you book a car, pay for their services with your credit card because to avail of this money-saving option.

If there is any damage (or) car theft, you can claim insurance benefits from the card company and thus you can save a lot of money on such occasions.

Some cards even come with personal insurance and accidental insurance policy, that covers the cardholder and even accompanying people.

3.7. Insurance Benefits

Most credit cards and debit cards have insurance benefits as an add-on feature for first-time customers.

The cardholder can claim up to Rs.5,00,000 (up to my research) insurance in case of any medical emergency (or) accident cases.

Don’t worry, there is no need to pay a premium to claim these insurance benefits because it’s absolutely free with your card.

Think of the yearly premium for Rs. 5,00,000 is Rs. 4000 and if you hold any premium card, you can save that Rs. 4000.

So these are the benefits of where you can save some money from your monthly expenses. Stop paying cash next time for your bills, monthly dues, etc.

Most credit cards come with a buyer protection and insurance policy, which means when you purchase any tangible goods with your credit card and you lost it (or) stolen within 90days.

You can claim insurance money within 90days from the date of purchase against all means of damages and losses.

Use a credit card and mobile wallet instead to save more money. Every time I say is, “Saving money is not quite spending, it’s how you spent smartly”.

4. How to Choose the Credit Card?

This is another question that comes after you read my article above. I need to explain this because not every credit cards are suitable for all.

Your spending pattern is not at all same as me (or) anyone.

For example, a man whose monthly earning is Rs. 60,000 will plan like

Rs. 3000 for Mobile and Internet bills

Rs. 3000 for EB bills

Rs. 6000 for Grocery

Rs. 2000 for Weekend Movie and Dine

Rs. 5000 for Shopping

Rs. 5000 for savings and insurance

Rs. 3000 for fuel every month

So, when you analyze this pattern, a single credit card does not give you maximum benefits.

You have to hold more than 2 (or) 3 credit cards to reap all the benefits under different categories.

I suggest you apply for one card with each major bank such as HDFC, SBI, AXIS, CITY UNION Bank.

These are the major card issuer’s as seen at great online stores such as Amazon, Flip kart, and other online merchants.

These cards have the most benefits at online shopping, spending at fuel stations, and Movie ticket bookings, and restaurants.

5. How to Apply for the Credit Card?

So you know the value and how to choose a credit card for your expenses. Now let’s see how to apply for a credit card?

1.) Normally a bank will choose the people from their account database and contact them if they are eligible for the credit card.

2.) Another way to apply for a credit card is against a fixed deposit. Most major banks issue cards to those customers with a secured fixed deposit.

The minimum amount of the fixed deposit is Rs. 20,000 INR and surprisingly there is a money-saving option here. You will earn monthly interest for your FD.

It may vary from 4% – 7.5% depending on the Banking partner you choose. You can get a credit card easily with the second method and once you have the first card, you can then easily get another.

But, remember to keep your track record without any defaults which may lead to a risk of applying for another card.

Don’t forget to read the disclosure information and perks from every spend with your credit card. Also, know the different insurance covered when applying for a credit card.

6. Credit Card Warnings

There are a lot of positive points when using a credit card, but at the same time, you should be aware of the negative side of having one.

6.1. No Cash Withdraw

The worst of the credit card is, when you drop cash with your credit card from ATM, the interest rates will flood your account.

Do not ever make any cash dealings with your credit card because the bankers may levy daily interest charged on your withdrawn cash.

I had the worst experience, where I withdrew Rs. 5000 from a credit card. My bill generation day was the 20th of every month and I drew cash on the 5th of the month.

But I repaid on the 9th, which is 4days from the date of withdrawal. But the bank levied interest rates for the entire billing cycle [5th – 20th].

I paid almost Rs.6500 on the 9th. So, you never make that mistake and use it only for purchasing any products (or) bill payments only.

6.2. Settle Dues On Time

Over-due interest is another worst side of the credit card. Normally you will get a 15days grace period from the statement generated to date to settle your dues and never forget this deadline.

The same thing will happen like what happened while withdrawing cash.

6.3. Do Not Over-Spend

Over-spending is the third important problem that needs care. Yes, normally you can spend more money than your credit limit on your credit card.

For example, if your credit limit is Rs. 20000, you can’t spend more than Rs. 20000. After that when you check your statement, you may go nomad.

Penalty, interest, service charge flood your statement and burn your hands.

So, every good has a bad, often use any instruments with knowledge.

It’s not 100% guarantee that credit card always does good for you, but it will do when you handle with knowledge and care.

Plan your spending, monitor your statements, and limit what you can able to pay after 45Days due.

Final thoughts,

Dear Friend, in this article I have shared some of the practical ways which I am following to save money whenever I am using my credit card.

The ideas and thoughts shared in this article are for information purposes only and it may (or) may not be suitable for every individual.

If you found this article informational, share it on your social networks and let your friends know you are intelligent.